Honda Of Bellingham Can Be Fun For Everyone

Table of ContentsHonda Of Bellingham Fundamentals ExplainedWhat Does Honda Of Bellingham Mean?Honda Of Bellingham for BeginnersOur Honda Of Bellingham StatementsThe Facts About Honda Of Bellingham Uncovered

It's More Than Finding the Right Vehicle. By shopping around at dealerships and among personal vendors for the automobile they enjoy the many. On average, over 60% of automobile customers money or lease their new or pre-owned automobile, numerous car buyers assume regarding where to finance as an afterthought.They go shopping and obtain pre-approved for financing before going shopping for a cars and truck. An automobile is the 2nd most expensive acquisition that many people make (after a house), so the payment and rate of interest rate issue.

There are three main sources for car fundings: dealers, banks, and debt unions. They have some things in common, but recognizing their distinctions will aid you get into the new or pre-owned auto that best matches your demands. It's attracting finance your new cars and truck right at the car dealership. You find the vehicle of your desires, organize to spend for it, and drive it off the great deal all within a few electrifying hours.

Fascination About Honda Of Bellingham

Additionally, if you enter warm water with your loan and miss out on a payment or more, you may find yourself handling a lending institution halfway throughout the nation that has no straight relationship with you and is not inclined to be as suiting as other local banks. And indeed, the supplier would choose you maintain paying the funding to ensure that they continue to earn money off the interest you are paying, however if you can not, they reclaim the lorry, recoup their losses, and go on, with little to no worry for the customer.

These promotions could include extremely low interest prices perhaps even 0% or attractive cashback offers. Remember, however, that these bargains are generally just offered on brand new autos and to customers with squeaky clean credit rating.

Considering that they know you and have a partnership with you, they might be willing and able to offer you a reduced rate of interest than a dealership. The financial institution may even offer rewards to funding with them if you do all your financial under their roofing system. When financing a car with a bank, you have the advantage of searching at numerous institutions in order to get an affordable offer or terms that best align with your spending plan and credit report account.

Honda Of Bellingham - The Facts

An additional important pro to funding via a bank is that you will avoid shocks. Banks will certainly check out your entire image initially, and afterwards created a car loan program that suits your requirements and that they are positive you can translucent reward. Once that is in location, you are armed with the right info you need before choosing the very best cars and truck for you.

Nevertheless, the large con for obtaining your financing through a financial institution is that the interest rates they offer are frequently greater than the national standard. Large, national financial institutions have a tendency to run 10-percent above ordinary and local banks run 24-percent over standard, while credit history unions normally use prices 19-percent below the national standard.

Despite the fact that a conventional bank can be an exceptional option for funding your new wheels, you might be in far better hands at a neighborhood lending institution. Banks are in business of earning money for the shareholders on top, which can convert into passion rates that are not as affordable as those at a lending institution, where the participant is additionally an owner.

Honda Of Bellingham Fundamentals Explained

A debt union is open to making changes and tweaks to the financing product to set you up for success. Credit scores unions this article are additionally recognized for their exceptional participant solution.

Once again, when you, the member, are stronger, the credit scores union is stronger. If you are already a credit score union member, or you are attracted to the individual touch and detailed education they provide, you are sure to find a great finance program there for your lorry purchase.

What make and model would certainly you actually such as? If you're willing to be adaptable amongst a few comparable choices, that aids your possibilities of getting the best deal.

The Basic Principles Of Honda Of Bellingham

When it comes to acquiring a car, one of the first choices you require to make is whether to acquire from an automobile dealer or a personal seller. Both options have their very own collection of benefits and drawbacks, and understanding them can substantially impact your car-buying experience. While cars and truck dealers use a vast selection of vehicles and specialist solutions, exclusive vendors often offer a much more personalized strategy and potentially lower rates.

Mr. T Then & Now!

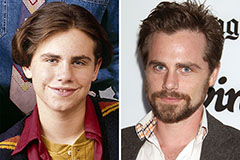

Mr. T Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Elin Nordegren Then & Now!

Elin Nordegren Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now!